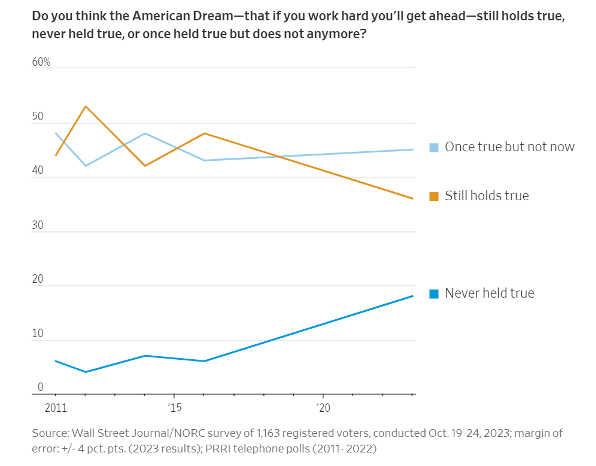

The American Dream – the idea that anyone from any background can succeed through their own efforts and initiative – is ingrained in our culture, and the U.S. was the first country where that lofty idea became a reality. Sadly, many Americans today are concerned that the dream is no more.

Regarding a poll it commissioned, the Wall Street Journal reports that the American Dream “has slipped out of reach in the minds of many Americans.” Only 36% said the American Dream still holds true. That’s a tragedy.

Bidenomics has put the American Dream out of reach for too many Americans with policies that have led to sky-high prices for basic necessities, mounting personal debt, higher interest rates, and lower real wages. No wonder 62% of Americans say they are living paycheck-to-paycheck.

Higher Prices, Lower Pay

Bidenomics has contributed mightily to the historic spike in inflation – particularly by adding another $5.5 trillion in new spending to an already bloated federal budget. Since Joe Biden took office, overall prices are up almost 18%, overall food prices up 20%, and overall energy up 32%. Currently, it costs American families $11,400 more per year just to maintain the quality-of-life they had in January 2021.

Meanwhile, wages have not kept up with inflation. Inflation-adjusted hourly wages are down 2.0%. And even as there have been some real wage increases recently, they have been more than offset by a decrease in the average work week. The result? Since January 2021, real weekly earnings have shrunk 4.4%.

MORE PERSONAL DEBT

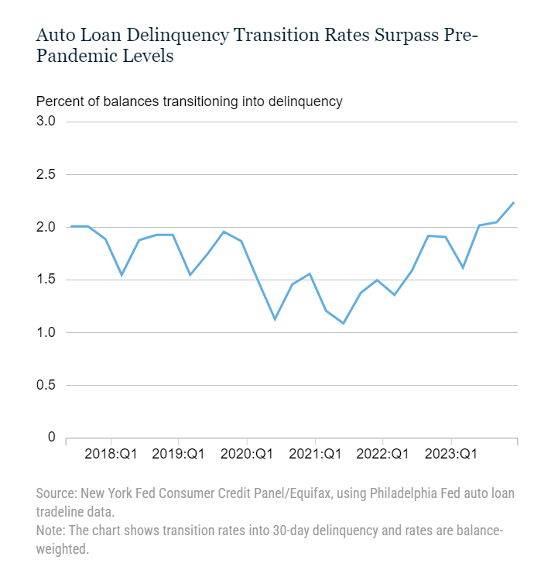

As costs outpace wages, people are forced to turn to debt to make ends meet – or just not pay their bills. The New York Fed reports household debt reached a record high of $17.5 trillion and that “both auto loans [see chart below] and credit cards have seen a particular worsening of new delinquencies, with transition rates now above pre-pandemic levels.”

Housing Harder

Some 94% of Americans say owning a home is a big part of the American Dream. But home ownership has become much harder under Bidenomics. Inflation has led to higher interest rates, pricing many Americans out of the housing market. Interest rates on 30-year fixed-rate mortgages have increased from 2.77% on January 21, 2021, to 6.8% as of February 15, 2024. The national average for a 30-year fixed rate hit a 23-year high – 7.79%.

Compounding the misery for homebuyers is that house prices have also increased since Biden took office – 16.5% since the fourth quarter of 2021. With the highest interest rates in over two decades and soaring housing prices, it is no wonder that the number of home sales fell to a 15-year low in 2023.

In a nutshell, the house costs more and the loan costs more – a double whammy. And it helps explain why 45% of all Americans aged 18-29 live at home with their parents, the highest share since the 1940s. Young people just can’t afford to get that all-important first home and begin building wealth.

Here’s what Bidenomics means to real people who can afford a home and would like to buy one. The average American mortgage is about $350,000. The difference in the monthly mortgage payment between the 3% loans that were around before Joe Biden took office and the 7% loans we are seeing now is $853 a month. With food and energy and everything else costing more, who can afford another $853?

The picture isn’t any brighter if you rent. High housing costs have caused rental prices to spike as well. In January 2021, the median asking rent price was $1,639/month before soaring to $2,054/month in August 2022 (a 25.3% increase in just 19 months). While the median asking rent price has now decreased to $1,964/month (December 2023), it is still 20% higher since Biden’s first day in office!

Bidenomics has made the American Dream inaccessible for too many Americans in too many ways.