Under Bidenomics, the outlook for debts and deficits is, to put it mildly, gloomy. The national debt was $27.8 trillion when Joe Biden took office; it’s more than $34.2 trillion today – or more than a quarter million dollars per household. As for deficits, the Congressional Budget Office projects that by 2031, $2-trillion-plus deficits will be the norm – a disaster for taxpayers.

THE CULPRIT: SPENDING

The cause is massive government spending – the essence of Bidenomics. If you add up the new spending initiatives pushed through by Joe Biden, it comes to a whopping $5.5 trillion over ten years. Here is how the CBO scored each of these major pieces of the Bidenomics spending agenda.

- American Rescue Plan: $2.10 trillion

- Infrastructure Investment and Jobs Act: $573 billion

- Inflation Reduction Act (IRA): $1.35 trillion

- The CHIPS Act: $79 billion

- PACT Act: $667 billion

- Aid to Ukraine: $113 billion (through Dec. 2023)

- SNAP increase: $185 billion

- Increased interest from all this new spending: $436 billion

We should also note that the Joint Tax Committee has revised its cost estimate for the IRA’s clean energy tax provisions from $271 billion to $570 billion, a $300 billion increase! Others estimate it could end up costing as much as $1.2 trillion. The bottom line? A bill that was supposed to cut the deficit will increase it…a lot. That’s Bidenomics for you.

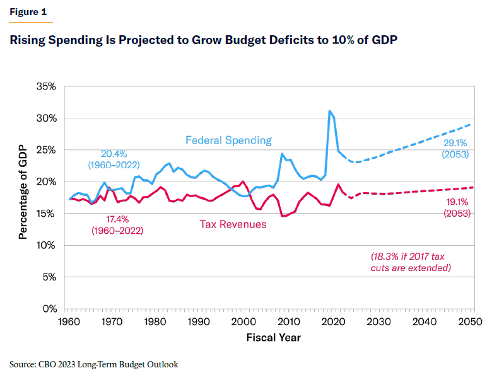

Again, that is all just new spending; it doesn’t count the ongoing growth of existing federal programs. Together, all this new spending will help drive up federal deficits to 10% of GDP – a level we’ve only seen in the modern era during the national emergencies of Covid and World War II.

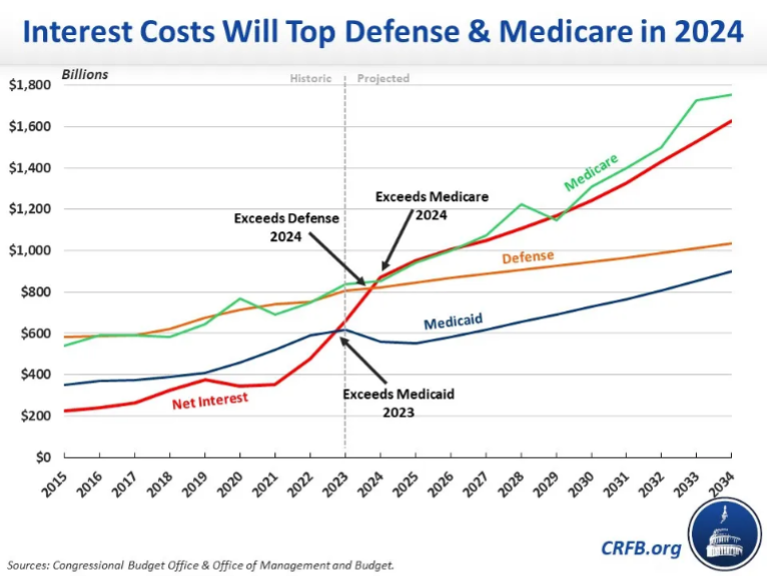

INTEREST ON DEBT SOARING

Of course, inflation also has a huge impact on how the government spends your money. When inflation goes up, interest rates go up with it, which means it costs the federal government more to service the huge sums it borrows.

According to the nonpartisan Committee for a Responsible Federal Budget, “Interest on the debt is the fastest growing part of the budget. Net interest payments will exceed both defense and Medicare spending this year, in Fiscal Year (FY) 2024.” That makes servicing the debt the second-largest federal program this year. Moreover, the CBO projects that in ten years, 38 cents of every income tax dollar will go toward interest on the debt. Bidenomics is robbing taxpayers, who see their hard-earned tax dollars going to pay interest to investors here and abroad instead of solving problems.

TAX INCREASES INEVITABLE

With the fiscal path the government is on, there will soon be a call for massive tax increases to pay for all this new spending. “Don’t worry,” the left will say, “we’re only going to tax the rich.” But a study by the Manhattan Institute’s Brian Riedl Budget demonstrates that even with an aggressive “tax the rich” strategy, we would not come close to getting our deficits under control.

Riedl writes, “the plausible revenue estimates from these [tax the rich] proposals fall far short of closing these budget gaps.” Our budget gap is projected to be 10% of GDP, but the most that could be raised by taxing just the rich is 2% of GDP. Where would the other 8% come from? The only alternative at that point will be hefty tax hikes on the middle class.

And who will pay those higher taxes? The young people of today as they grow into adulthood, and they didn’t sign up for any of this. Make no mistake, the reckless fiscal policies of this administration represent a form of intergenerational theft on an unimaginable scale. That will be the legacy of Bidenomics’ reckless spending policies.